4 Valentine’s Day 2020 Confectionery eCommerce Insights to Know

Presented by:

e.fundamentals — 2020

With more than 32 million Brits spending nearly £1.45bn* on their loved ones this Valentine’s Day, and with confectionery being the usual gift of choice, it is not surprising that chocolate and sweets took a large share of the eCommerce sales for this holiday and category managers are looking at ways to optimize product performance online.

To help eCommerce managers get the best insights and learnings from Valentine’s Day 2020, we took a closer look at the products directly targeting the occasion in UK grocery to find where they were ranged, promoted and which brands took the biggest share of the digital shelf.

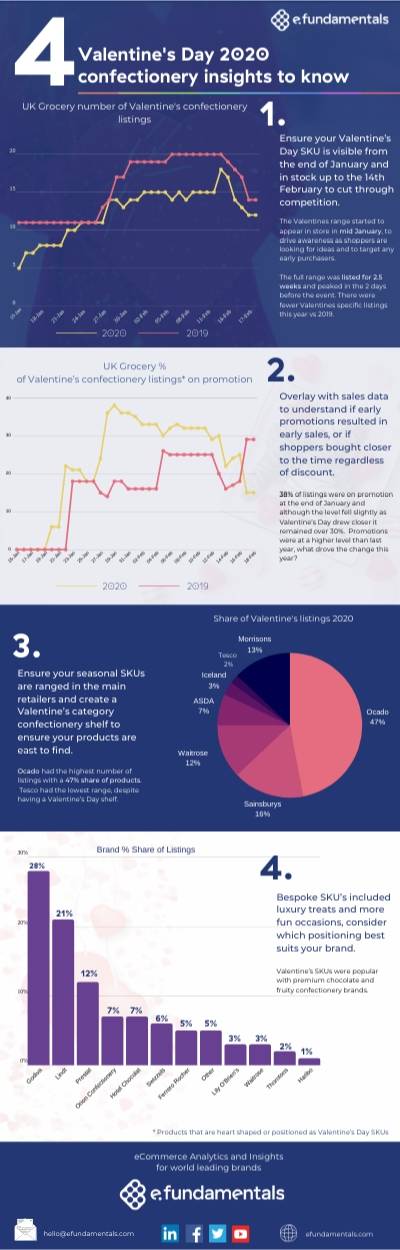

1. Ensure your Valentine’s Day SKUs are optimized to cut through competition.

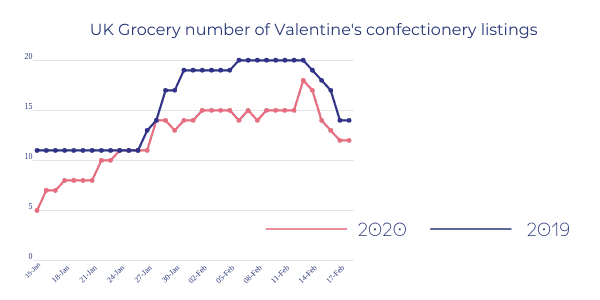

Valentine’s stock started to appear online from mid-January right up until the big day itself. This assists in driving awareness as shoppers are already looking for gift ideas, and also allows the marketer to target the earlier purchasers.

The full range of SKUs were listed for 2.5 weeks and peaked just 2 days before Valentines; this year, however, there were fewer Valentines specific listings for 2020 vs 2019.

2. Understand if early promotion results in early conversion

If you overlay your sales data to the data below you will be able to understand if shoppers bought closer to the time regardless of any discounts, or if sales promotions resulted in earlier sales. This will help you understand one of your key sales drivers during the holiday period.

The data showed us that for Valentine’s day 2020, 38% of listings were on promotion by the end of January, but as Valentine’s Day drew closer, promotions dipped slightly, yet remained over 30% through 14 February. Additionally, promotions were at a higher level YOY perhaps indicating why there were fewer listings in 2020 as it becomes harder to sustain effective margins.

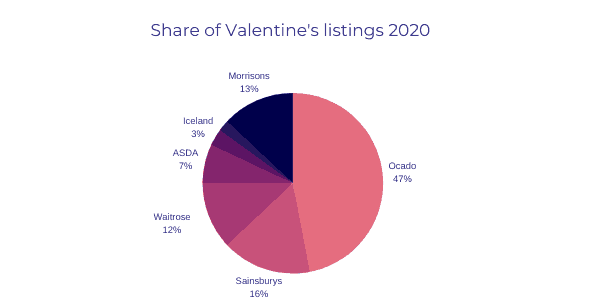

Ensure you’re listing your SKUs with the main retailers and make sure you are making your confectionery the easiest to find by creating a Valentine’s category.

Did you know that in 2020, Ocado had the highest percentage of valentine’s listings? Ocado had a 47% share of products, and Tesco had the lowest range, despite having a Valentine’s Day shelf.

4. Consider the best positioning for your brand

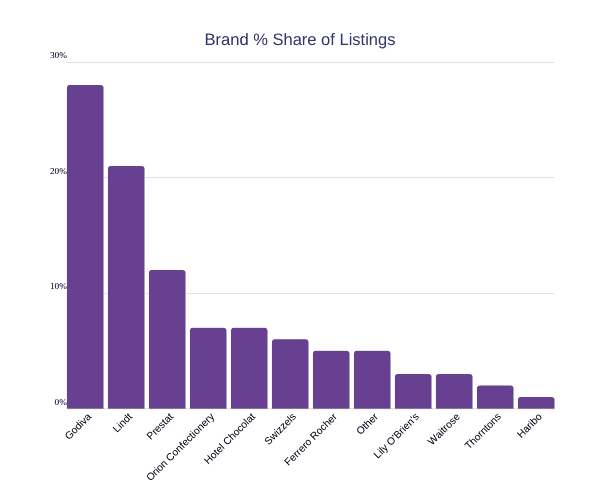

Bespoke SKUs included luxury treats and more fun occasions, with premium chocolates and fruity confectionery being the pick for Valentine treats.

As a brand owner identify if your product(s) are suitable for the most popular Valentines ranges, ensure imagery, pricing and your brand USP’s align to the target shopper. Godiva, Lindt and Prestat were the most effective at getting brand coverage over the Valentines period.

Download the full Valentines Day 2020 Infographic

We summarized all the above-mentioned Valentine’s Day insights in a quick infographic. Download the high resolution version here

Optimize your brand for eCommerce

If you are looking to get daily actionable intelligence where you can inform your overall eCommerce strategy, speak to us at e.fundamentals to learn how our eCommerce analytics platform can support your brands online needs.

Learn 5 ways category managers are looking to boost sales in 2020?

All the digital Shelf Analytics You Need to Succeed at Speed & Scale

See why world leading brands choose e.fundamentals for actionable digital shelf insights

Request A demoLatest Resources

CommerceIQ Launches Global Retail Ecommerce Management Platform Combining Sales, Supply Chain, Retail Media, and Digital Shelf with e.fundamentals Acquisition

Ecommerce platform enables consumer brands to grow market share profitably in today’s inflationary and supply-constrained environment through intelligent automation, supporting over 450 omnichannel retailers in 41 countries.

e.fundamentals becomes a CommerceIQ company

e.fundamentals has been acquired by CommerceIQ, the leading Retail Ecommerce Management Platform, headquartered in Palo Alto, California. Consumer brands can now harness one global software platform to power profitable market share growth across all major retailers.

5 strategic pricing opportunities CPGs should focus on now

As tensions run high between retailers and suppliers, CPGs need to be smarter than ever about strategic pricing. Here’s how to use digital shelf analytics to hold your own in tough negotiations.

What the smartest CPGs get right about selling on Instacart

This post has been updated and was originally published March 30, 2021. It's time CPGs get ready to win on Instacart. So read and learn: What's all the hype around…

5 optimization tactics to grow digital shelf sales

This post has been updated and was originally published May 14, 2020. Consumer goods companies (CPG) continue to grapple with enormous shifts to the industry as the eCommerce boom continues…

5 tactics to grow online sales for category managers

Category management has changed. We've highlighted the 5 tactics to help you scale your growth on the digital shelf at speed.

View Our Most Popular resources to help you learn and win on the digital shelf.

The Ultimate Guide to Content Management on the Digital Shelf

The Digital Shelf Cast - Listen to our latest episode