How to build a stronger brand with eCommerce analytical tools, Part 1

Presented by:

Josi Mathar — 2020

As a brand owner selling through online retail websites like Tesco, Amazon and Walmart, now more than ever do you need retail insight data to help make the right decisions for your brand. There is a myriad of guidance on the internet, from brand building to digital marketing however this wealth of information doesn't always make figuring out what's most beneficial for your brand easy when it comes to optimising your brand for online retail.

Instead of testing out tactics while crossing your fingers, let us give you a full breakdown of how eCommerce data analytics and insight works and how you can use it to drive your online market share and revenue growth through actionable insights.

.jpg)

Stop looking for a sign. Use eCommerce data analytics and insight to drive your online market share and revenue growth through actionable insights.

Understanding eCommerce analytics use cases for CPG brand growth

Ecommerce analytics provides you with knowledge about how your brand is performing online. Simply put, these data points convert to useful insights that can help your eCommerce teams better understand how your products are seen across online retailers. More so, this data when relevant also helps brand owners, sales individuals and marketers make the commercial decisions that accelerate online sales and increase profitability.

In general, eCommerce analytics can help you answer the following key questions:

- Am I using the correct imagery to showcase my products?

- Where can I focus my team's sales efforts to improve online sales?

- What are my competitors doing today that will impact my brand tomorrow?

- How does my pricing model compare to similar products sold by the competition?

- Are my products being found by shoppers when they search across retailers?

- Are my product listings meeting brand compliance rules and regulations across my markets?

- How do I know when to drive promotions or commercial upsell activities?

- How do I manage pricing, promotion, presentation and assortment to build a more profitable online business?

- Crucially, is my eCommerce strategy working?

If you have found yourself or your teams discussing the above in the context of online retail then the answer to where you need an eCommerce insights platform is a resounding yes.

Regardless of whether your trusted 3P sellers, such as Amazon or Walmart, provide you with sales numbers and conversion rates, this data doesn't present a complete picture.

As more retailers shift their investment into eCommerce your teams need to know what levers to pull across multiple channels. It is no longer enough to focus your eCommerce efforts on one or two big players online. The online retail landscape has now changed and the brands that succeed in this new normal will be those that have equipped their sales, marketing and commercial teams with the data to unlock growth.

However, data alone cannot ensure success: brands need to know they have the right skills and knowledge to win online. In fact 34% of CEO’s site skillset as a key area that prevents growth. Online retail demands teams have the knowledge of what works, what's different and where to focus in order to optimise the chance of success. It's little wonder then that 77% of CEO’s also stated that operational effectiveness and organic growth are key focus areas for the next 12 months, a figure pre COVID19. Online retail certainly offers the opportunity to achieve growth, leaders will also want to integrate with a platform that helps your brand and commercial teams better understand the drivers as well as blockers behind your sales numbers. That way, you can optimise your eCommerce efforts accordingly to maintain a competitive advantage online.

🎬Watch our FREE webinar: How to Lead your Digital FMCG Transformation

.jpg)

Integrate with a platform that helps your teams better understand the drivers as well as blockers behind your digital shelf sales numbers.

Current events and the importance of eCommerce analytics

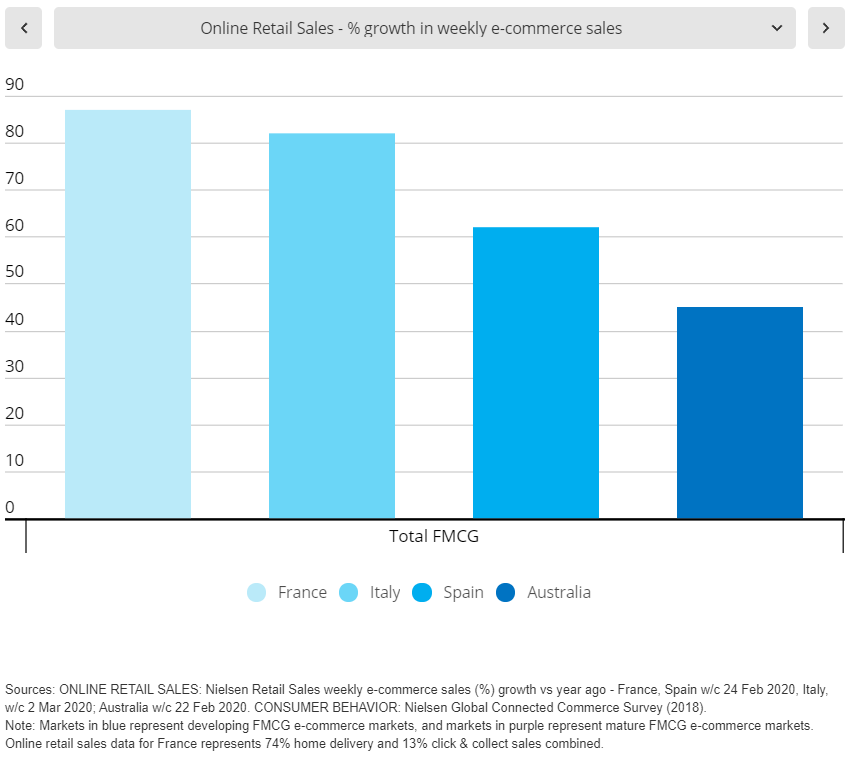

The UK's eCommerce sales skyrocketed 9.4 percent this past December pre COVID-19, and since COVID-19 categories seen as slow to adopt online retail such as fresh produce and online grocery are seeing change driven much faster than expected due increased consumer demand and it’s growth isn’t expected to diminish anytime soon as consumers adapt to choosing an online first shopping approach. Critically, this isn't just a single market trend, across the globe mature and developing eCommerce markets are seeing up to 80% week on week growth in eCommerce sales.

With the world gripped by COVID-19, many brick and mortar shops experienced difficulties keeping their shelves stocked.

As a result, customers have started turning to online shopping for groceries and other necessities for the first time. As a brand leader ambitious to drive sales and profitability, it’s more important than ever to respond to mounting challenges online with a topical fit for purpose eCommerce strategy. Whatever your strategy is coming into 2020 one thing is for sure, COVID-19 has altered the demands and eCommerce has fast become the top priority for brands selling through retail.

As we embark and navigate unprecedented change, having your eCommerce teams armed with automated actionable insights to power revenue growth, product availability and visibility will be instrumental in winning market share online.

“The eCommerce channel continues to grow in importance for us and we’re really pleased to partner with e.fundamentals [which fits into the business as part of a wider company focus on eCommerce].” James Brett, Head of Customer Marketing Twinings

To navigate unprecedented change, your eCommerce teams need automated actionable insights to power revenue growth, product availability and visibility to win market share online.

Why you need dedicated online category management analytics and insights software

There are a variety of factors you must consider when moving focus to online: you want to ensure that your products are listed as intended but also that you gain an understanding of where opportunities exist so that you can enhance listings for growth and premium product categories - a factor we’ve compiled under the fundamental Sell the Benefits, and that your products comply with regulatory requirements which we summarise under Fix the Basics. Both fundamentals are part of our 8 fundamental framework of winning in online retail.

For category managers, insight data can help build and optimise the buying journeys for your brand's online customers. What worked in store is applicable to the online landscape - it's just the mechanism that has changed. You don't have that end aisle stand, but you do have the ability to leverage category pages and themed display advertising to help your products gain mind share and visibility. End aisles and physical displays work well in stores, but online, the journey from browse to consideration to purchase is much harder to craft if you don’t have the data to illustrate the full picture.

Fortunately, an integrated eCommerce platform can help you keep track of these variables or what we call fundamentals and thus guaranteed optimised customer journeys that help drive shopper views to conversions in basket.

.jpg)

Online the journey from browse to consideration to purchase is much harder to craft without the data to illustrate the full picture.

The key to promotional effectiveness: a winning campaign backed by retail insights

What is the secret to more online sales? Execution of a winning campaign that optimises your promotional competitiveness. The right eCommerce platform can help you do just that. Let us explain how.

Developing a winning campaign is based on an overview of promotional activity across your key competitors and categories both current and historical. Armed with this retail insight and knowledge, brands can promote products much more effectively across target retailers for enhanced revenue gains.

A view of the promotional landscape across a category offline helps inform competitor activity online, it also serves to inform decisions your category managers and commercial teams can take within physical retail stores. What's more, this data will help you plan promotions in a way so that you run the right activity at the right time optimising your eCommerce strategy in real time. With e.fundamentals, you have access to such promotional data for the online landscape across all your key retailers. This arms your commercial, marketing and sales teams to fully understand and join up the in store and online promotional campaigns so that you promote and campaign effectively with a true omnichannel strategy.

With retail promotional insights and analytics your commercial and brand teams will be able to see all of your competitors promotional activity in one place, then click on any promotion and see how it's performing on a retailer's website. With access to your competitors' historical promotional activity, you can spot commercial opportunities throughout the calendar year anticipating market trends. Unlike in store such promotional activity also plays a part in driving product visibility; yes promotions make your product stand out on the store pages, but promotional activity also plays a role in supporting your brands online rankings when it comes to retail search engine optimisation. Thus, our eCommerce data analysis will revolutionise how you position your products with different online retailers. It'll give you a head-and-shoulder advantage over the competition. A true master plan for unlocking growth.

“We wanted an eCommerce partner that could move beyond just fixing the basics. The actionable insights the e.fundamentals tool provides will allow us to develop our online sales channel and bring our category vision to life.” Sean Ferguson, Digital marketing manager Molson Coors

Use eCommerce analytics to drive your online growth in times of changing consumer spending habits.

Preliminary conclusion

To succeed in the New Normal, brands needs to prioritise the online shopping experience now. It's essential to do so exploiting an eCommerce data analytics provider to ensure marketing and sales team get a holistic view of product display and campaign performance across retailers.

We discussed the following aspects essential to building a stronger brand online:

- Understanding eCommerce analytics use cases for CPG brand growth

- Current events and the importance of eCommerce analytics

- Why brands need dedicated online category management analytics and insights software

- The key to promotional effectiveness is a winning campaign backed by retail insights

In part II of our series "How to build a stronger brand with eCommerce analytics", we're looking at 4 more aspects essential to strengthening your brand with eCommerce analytics such as Shopper Marketing insights, pricing and promotion and impediments to online sales and eCommerce analytics for better NPD execution.

We're dedicated to driving your success on the digital shelf. Think you're ready to review your current strategy? 💬Get in touch for a free consultation with our eCommerce experts.

All the digital Shelf Analytics You Need to Succeed at Speed & Scale

See why world leading brands choose e.fundamentals for actionable digital shelf insights

Request A demoLatest Resources

CommerceIQ Launches Global Retail Ecommerce Management Platform Combining Sales, Supply Chain, Retail Media, and Digital Shelf with e.fundamentals Acquisition

Ecommerce platform enables consumer brands to grow market share profitably in today’s inflationary and supply-constrained environment through intelligent automation, supporting over 450 omnichannel retailers in 41 countries.

e.fundamentals becomes a CommerceIQ company

e.fundamentals has been acquired by CommerceIQ, the leading Retail Ecommerce Management Platform, headquartered in Palo Alto, California. Consumer brands can now harness one global software platform to power profitable market share growth across all major retailers.

5 strategic pricing opportunities CPGs should focus on now

As tensions run high between retailers and suppliers, CPGs need to be smarter than ever about strategic pricing. Here’s how to use digital shelf analytics to hold your own in tough negotiations.

What the smartest CPGs get right about selling on Instacart

This post has been updated and was originally published March 30, 2021. It's time CPGs get ready to win on Instacart. So read and learn: What's all the hype around…

5 optimization tactics to grow digital shelf sales

This post has been updated and was originally published May 14, 2020. Consumer goods companies (CPG) continue to grapple with enormous shifts to the industry as the eCommerce boom continues…

5 tactics to grow online sales for category managers

Category management has changed. We've highlighted the 5 tactics to help you scale your growth on the digital shelf at speed.

View Our Most Popular resources to help you learn and win on the digital shelf.

The Ultimate Guide to Content Management on the Digital Shelf

The Digital Shelf Cast - Listen to our latest episode